After months of waiting, we’re finally seeing some relief on mortgage rates. As of this writing, the 30-year mortgage rate has now dropped to around 6.32 – some of the lowest rates we’ve seen all year. Furthermore, many experts think rates could get close to 6% by the end of next year.

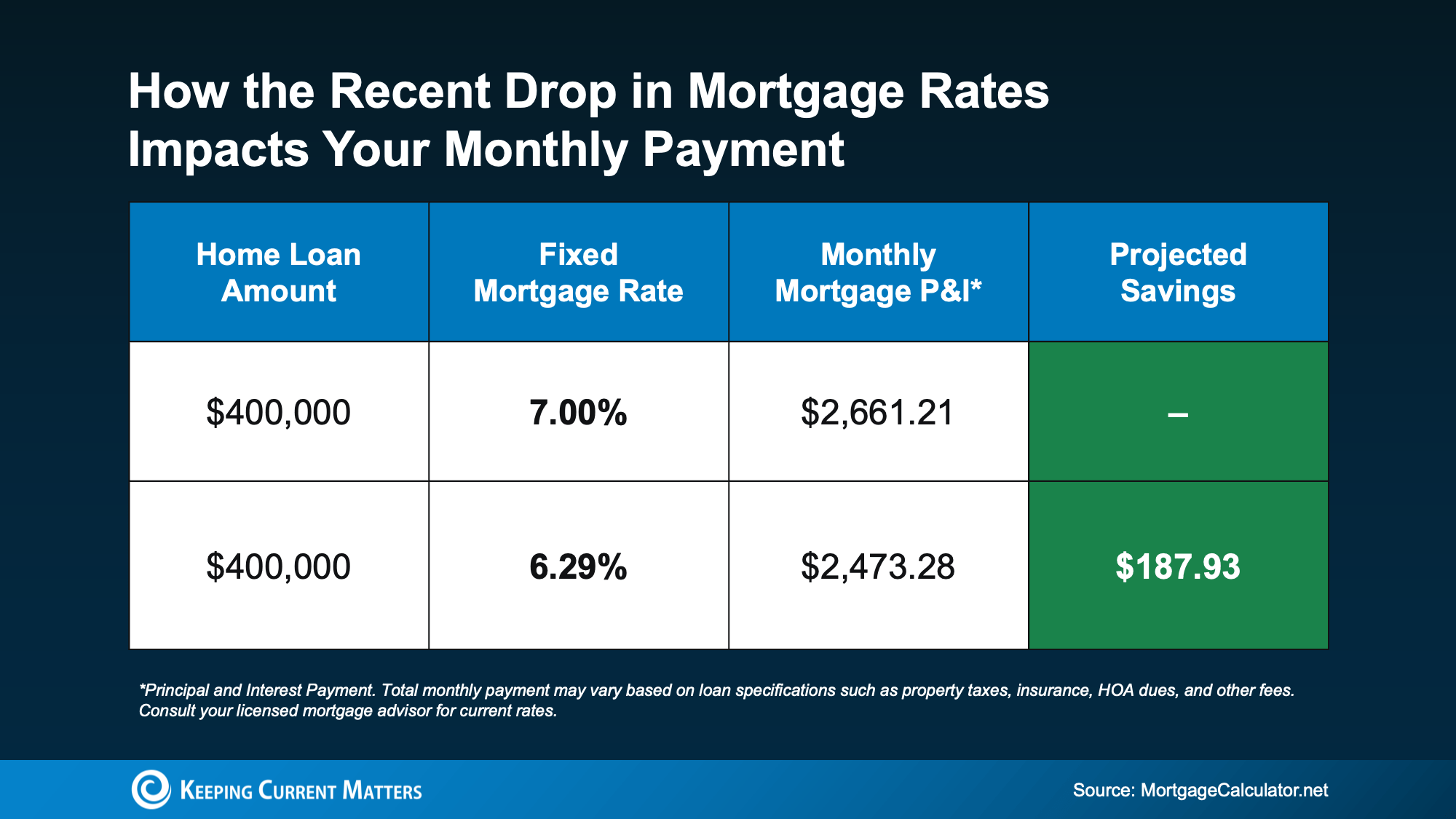

Lower rates mean increased purchasing power for buyers- even a half-point drop in mortgage rates can save hundreds of dollars per month on a typical home loan:

This added buying power can bring more buyers into the market, and that ripple effect impacts sellers too, since a larger pool of qualified buyers means more demand for well-priced homes.

What This Means for Home Prices

You might think lower rates automatically mean higher home prices, but experts are not expecting the very large price jumps we saw during the pandemic years. Instead, prices are expected to rise by a much more reasonable 2% next year, bringing the median home price to about $410,700. In Portland, OR, the local market reflects many of these national shifts: homes are staying on the market longer, and competition is easing in many neighborhoods. As of August 2025, the average days on market is 62 days.

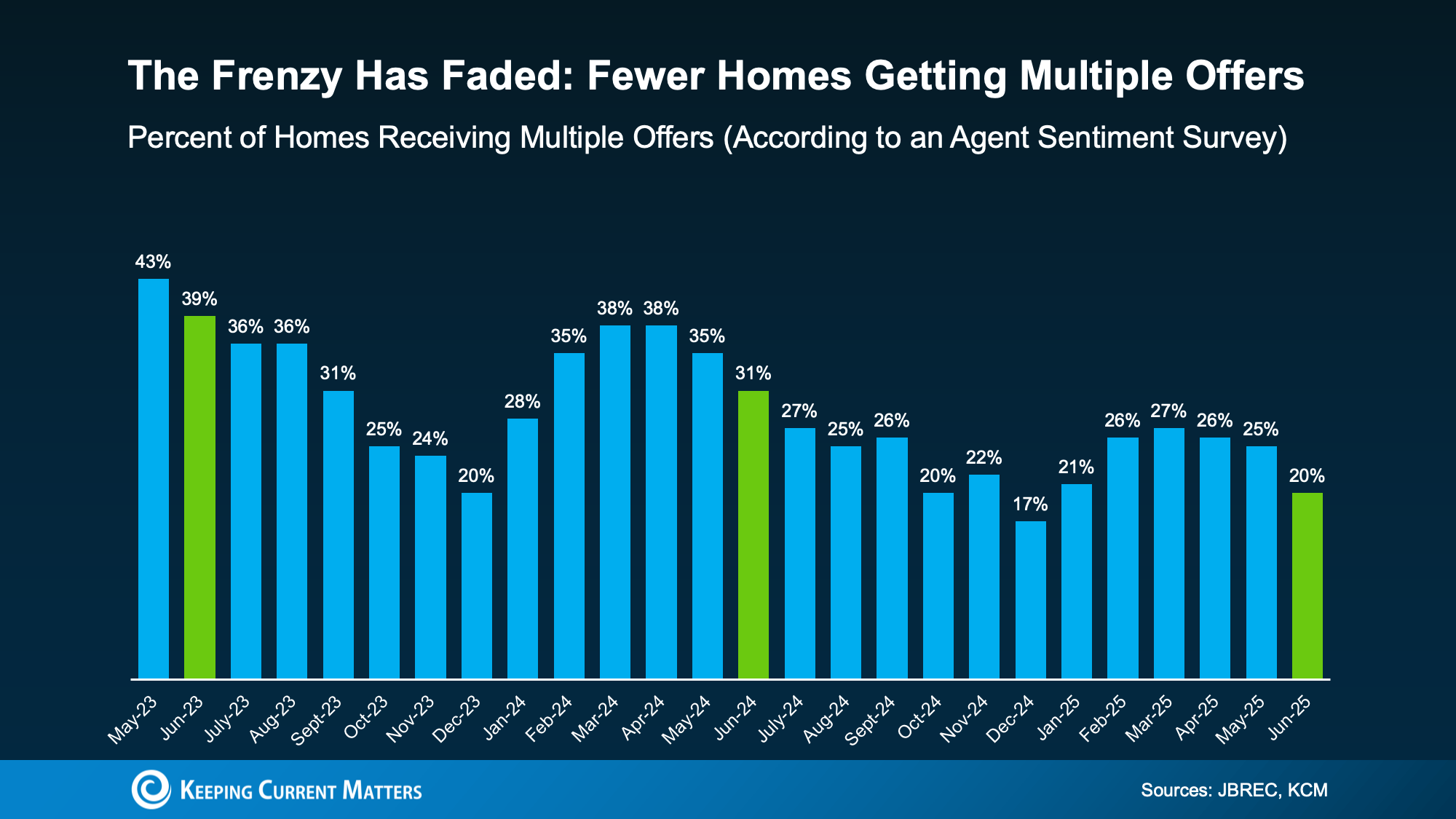

The days of intense bidding wars seem to be (mostly) behind us. As this chart shows, the percentage of homes receiving multiple offers nationwide has dropped sharply from over 40% in 2023 to just 20% by mid-2025:

While “hot” properties (ones that are well‐priced, in desirable locations, and in good condition) are often still getting multiple offers and sometimes selling above asking price, the overall the pace of the market is calmer and more balanced. For many buyers, that means more room to negotiate.

Portland Update

The Portland metro housing market showed steady seasonal movement in September. New listings (2,498) were down 3.5% from September 2024 but up 0.9% from August 2025, signaling consistent seller activity heading into fall. Pending sales (2,145) rose 3.3% year over year. Inventory increased to 3.8 months, and the average market time held at 62 days, giving buyers slightly more choice while keeping moves moving at a steady pace. Year to date, the market remains stable, with new listings up 2.6%, pending and closed sales up 1.6%, and prices showing modest growth.

The Bottom Line

If you’ve been waiting for mortgage rates to improve, this is encouraging news. The trend is moving in the right direction, meaning more opportunity for buyers and a more predictable market with steady, modest price growth.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link