| One of the questions I get asked often is, “What’s going on in the market?” The honest answer: it’s always evolving, and location matters. To kick off 2026, I wanted to look back at what we saw in the Portland real estate market in 2025, and share a few thoughts on what may be ahead this year.

LAST YEAR: Interest rates fell: we started at around 6.7, experienced some volatility, and ended the year around 6.2. This drop makes a big impact in monthly mortgage payments and played a big role in increasing affordability for buyers. Home prices were up… but location dependent. North Portland experienced the biggest jump in home prices at 4.3%, followed by the Southeast (2.8%), West Portland (2.2%) and Northeast Portland (1.8%). Nationally, home prices rose 1.7%. Homes took longer to sell: The average home in the Portland metro area spent around 20% longer on the market in 2025 compared to the previous year. Homes in Northeast Portland moved the fastest (45 days), while homes in West Portland took the longest (70 days). Inventory was up: more homes on the market meant more options for buyers. At 29.6%, the West side saw the greatest inventory jump while Southeast Portland experienced the smallest (9.8%). Nationally, inventory increased 15%. Absorption rate (the percentage of homes that sell compared with what’s listed): varied across Portland neighborhoods in 2025. Inner Portland continued to see the strongest and most consistent demand, with homes selling quickly and little change from last year. North Portland picked up nearly 13%, suggesting more buyers are exploring this area, possibly spilling over from NE Portland or seeking more affordable options. West Portland remains slower overall, but sales activity is improving, with absorption rising about 10%. LOOKING AHEAD In general terms (and notwithstanding unforeseen world events), experts are expecting the general trends we saw in 2025 to continue in 2026, improving affordability, inventory, and overall home sales volume. It’s likely Portland will broadly experience the same trends expected to unfold on a national level. Here is what the experts are predicting for 2026: |

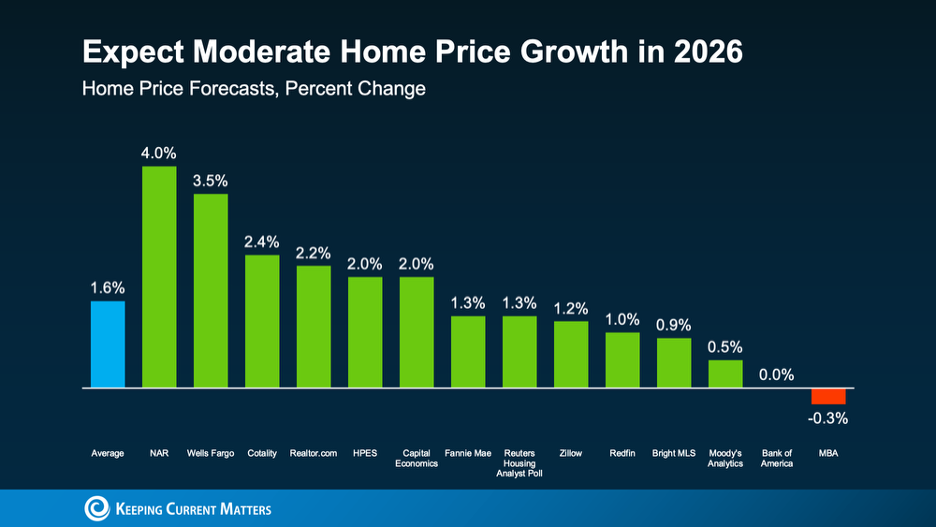

| Home prices will continue to grow between 1-3%:

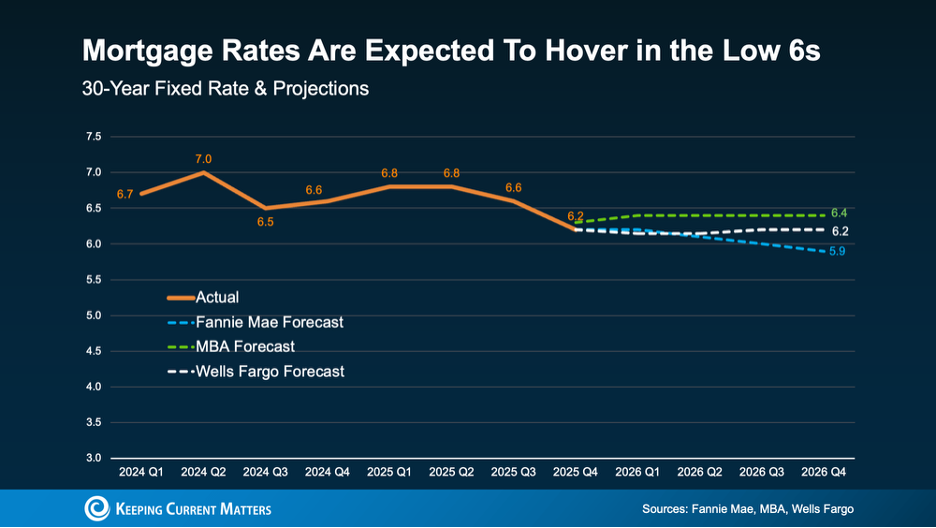

Mortgage rates will continue hovering in the low sixes:

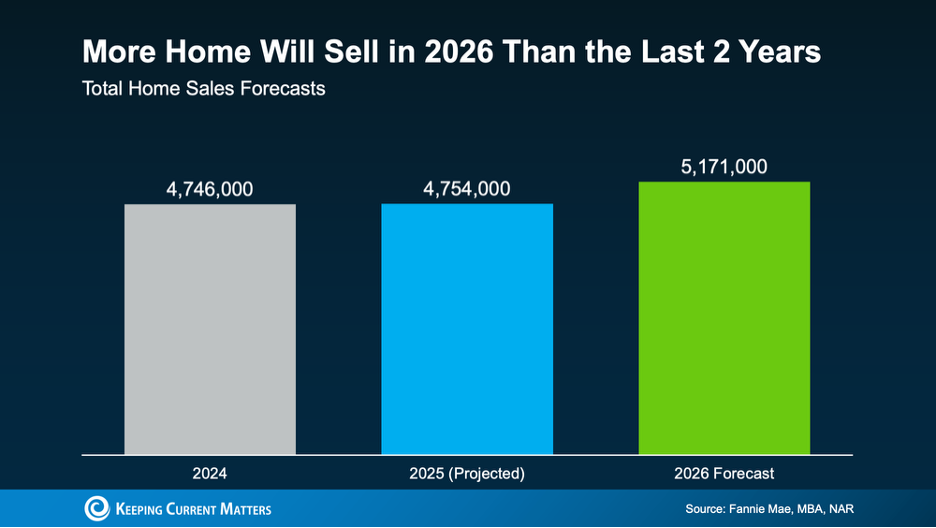

And more homes are expected to sell this year:

Overall, the 2026 housing market is looking like we will continue to take steps in the right direction toward a balanced, more normalized, more affordable market. As Mischa Fisher, Chief Economist at Zillow says, “Buyers are benefitting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.” Cheers to that. |

|

||||||||||||

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link